Doing the Math

Decrypting the Tax Law Lingo

Our numbers estimate that our new solar array will pay for 96% of its purchase, installation, and operating costs over a 6 year period. This document answers a few FAQ’s about the numbers behind the payback.

The rest of this page references a spreadsheet with all the summary calculations shown. You can view that spreadsheet here as a PDF (opens in a new window).

Alternatively, you can find a PDF containing both the spreadsheet and all of the analysis content on this page for easy printing here.

How is the federal solar tax credit calculated?

The federal solar tax credit is calculated as 30% of the array purchase price; our federal tax credit is ($71,000 * 30%) = $21,300.

TS Designs is an S-Corporation, which means its income, and thus its tax burden, is transferred to its owners (Tom Sineath and Eric Henry). Because the federal tax credit will be claimed by Tom and Eric, the AMT (alternative minimum tax, a tax affecting individual income) will affect how much can be claimed in any given year (which is why the credit is spread over several years in varying estimated amounts on our attached payback analysis spreadsheet).

How is the NC state solar tax credit calculated?

The state solar tax credit is calculated as 35% of the array purchase price, divided evenly among the first 5 years. Our NC tax credit is ($71,000 * 35%) = $24,850, so we can take a $4,970 credit each year for five years.

What is depreciation and why should I care?

Depreciation spreads the cost of an asset over the span of (typically) several years. When you depreciate a piece of equipment, you can write the expense off on your taxes (i.e. reduce your taxable income).

How does depreciation help me pay for my solar array?

Because TS Designs’ income and taxes are passed to its owners, TS Designs’ tax bracket will vary in some cases, but for our purposes we will use a 35% tax bracket (28% federal, 7% state), which means that writing off an expense allows us to subtract 35% of that expense directly from our taxes owed (also known as the tax savings amount).

So, theoretically, if TS Designs were to write off the full $71,000 purchase price of its new solar array, we would create a tax savings of ($71,000 * 35%) = $24,850, which would then be spread across several years.

In other words, by buying the solar array you can directly save a large amount on your taxes just for spending the money.

Calculating the depreciable amount

Unfortunately, it’s not quite as simple as it looks in the previous section (surprise!). The government allows you to depreciate an amount equal to the purchase price of the asset minus 50% of the federal tax credit taken on the equipment.

So, the formula for the depreciable amount is [Purchase Price] – ([Federal Tax Credit]/2). Plug in the numbers and you get $71,000 – ($21,300 / 2) = $60,350, our total depreciable expense. Multiply that by 35% to determine the tax savings: ($60,350 * 35%) = $21,124.

In simple terms, purchasing our solar array at $71,000 directly saved us $21,124 (almost 30% of the purchase price) just because we bought the installation.

When can I claim those tax savings?

That depends partly upon when during the year you buy the equipment. TS Designs bought its solar array in the 3rd quarter of 2008. Standard property depreciation for any quarter other than a 4th quarter purchase looks something like this:

Calendar Year 1: 20%

Calendar Year 2: 32%

Calendar Year 3: 19.2%

Calendar Year 4: 11.52%

Calendar Year 5: 11.52%

Calendar Year 6: 5.76%

So, if TS Designs depreciated the solar array with standard property depreciation rules, the numbers would look something like this:

Calendar Year 1: 20% * $60,350 = $12,070

Calendar Year 2: 32% * $60,350 = $19,312

Calendar Year 3: 19.2% * $60,350 = $10,380

Calendar Year 4: 11.52% * $60,350 = $6,952

Calendar Year 5: 11.52% * $60,350 = $6,952

Calendar Year 6: 5.76% * $60,350 = $3,476

Multiply those numbers by 35% and you get the actual tax savings for each year. Note that 4th quarter purchases may require an entirely different six year depreciation schedule.

Having said all of that, there is one extra complication (weren’t you expecting one?). Congress passed a law allowing accelerated depreciation equal to 50% of the total depreciable amount to be written off in the year of purchase. In short, that means that 50% of the $60,350 can be written off immediately in the first year!

Unfortunately, as of this writing (Sept. ’08), this 50% accelerated depreciation is only available for purchases made in 2008, so this may or may not apply to your calculations depending upon whether this policy is extended or not.

So we depreciate $30,175 right away in Calendar Year 1 (see blue text in calculations below). Other than that, the percentages still hold, except now they’re multiplied against the remaining half instead of the full depreciable amount. Here’s how it looks taking advantage of the accelerated depreciation:

Calendar Year 1: 20% * $30,175 = $6,035 + $30,175 = $36,210

Calendar Year 2: 32% * $30,175 = $9,656

Calendar Year 3: 19.2% * $30,175 = $5,794

Calendar Year 4: 11.52% * $30,175 = $3,476

Calendar Year 5: 11.52% * $30,175 = $3,476

Calendar Year 6: 5.76% * $30,175 = $1,738

If you compare these numbers to the “Depreciation on Hardware” in the payback analysis spreadsheet, they will match up. These numbers are then multiplied by 35% in order to determine the direct tax savings we will receive each year.

What about Section 179?

If you’re an accountant, you may be asking yourself why we didn’t elect section 179. For those of us who aren’t super accounting geniuses, section 179 allows the depreciable amount of a purchased asset to be written off entirely in the year of purchase. Obviously this is advantageous because you get the full tax savings right away, and money now is better than money later.

The problem with section 179 is that in NC, the state solar tax credit is not available when 179 is elected. Thus, standard depreciation is preferable (even though it spreads the tax credits over several years).

What is the NC Add Back / Deduction?

North Carolina requires 85% of the federal accelerated depreciation to be added back in the year it is claimed. Then, an extra deduction equal to 20% of the add back can be taken over the next five years. Our NC state tax bracket is 7%, so to determine the actual credit / debit against our taxes 7% is multiplied by the add back / deduction for each year. The effect causes additional NC taxable income in year 1, but extra NC deductions in years 2-6.

If you remember from the depreciation section, our federal accelerated depreciation is half of the depreciable amount, so $30,175. (85% * $30,175) = $25,649. To determine the tax cost of that direct add-back, multiply that number by 7% (our NC state income tax). (7% * $25,649) = $1,795. These numbers all appear on the spreadsheet.

In short, you have to pay back a portion of the payback from the federal accelerated depreciation to the state. But, you then receive 20% of that extra tax burden back every year for the next 5 years, so ultimately you end up getting all that money back.

How is the power generation income determined?

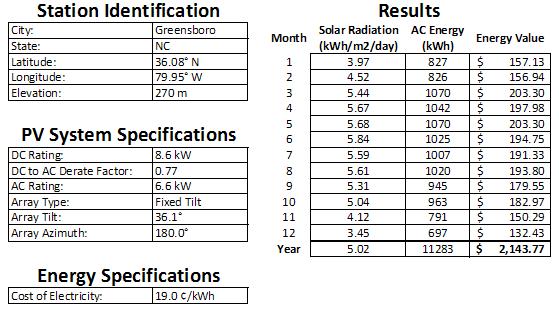

The estimated income from power generated is based upon data from the National Renewable Energy Laboratory (NREL).

Rounded to the nearest dollar, $2,144 is the estimated yearly return from energy generated. After tax (35%) that equals $1394 yearly net savings, or $116 monthly net savings.

Calculation Review

These number were calculated and reviewed by accounting firm Davenport, Marvin, Joyce & Co., LLP.

Thanks

Credit goes to DMJ Accounting for doing all the real work with the numbers and the calculations and the crazy tax law stuff. Special thanks to Tracy Valentine for patiently answering all my inane questions.

Caveats (DMJ’s legal mumbo jumbo)

This information is a generic explanation of tax provisions. Not all of these provisions will apply to every taxpayer in every situation. Please consult with your personal tax advisor before taking any action based on this information.

Under Treasury Circular 230, please be advised that, based on current IRS rules and standards, the advice contained herein is not intended to be used, nor can it be used, for the avoidance of any tax penalty that the IRS should assess related to this matter.